Is Priority Gold a scam or a legit precious metals firm? Should you buy precious metals from them, or should you look elsewhere? Please read this objective review of Priority Gold as it contains all the information you need to know about them.

Your Golden Opportunity Awaits—See the Best Gold IRA Companies Trusted By Savvy Investors!

About Priority Gold

Priority Gold is a company based in Sherman Oaks, California that specializes in gold and silver bullion and rare coins. Since 2015, Priority Gold has facilitated the rollover of IRAs into gold and silver for its customers. The organization collaborates with Preferred Trust Company to provide custody services. Priority Gold does not disclose the depository with which they partner to provide storage services. In addition, fees and pricing information are not disclosed on their website; you must call or send an email to inquire. In contrast to the majority of precious metals companies, Priority Gold does not sell palladium or platinum products.

Priority Gold Review Summary

Location:

Sherman Oaks, California

Address:

15260 Ventura Blvd #610

Sherman Oaks, CA 91403-5371

Year Founded:

2015

Management:

Mike Anderson (Operations & Marketing Manager)

Website:

www.prioritygold.com

Rating:

[3.5/5] Not recommended

Discover Our #1 Recommended Gold IRA Provider Now!

Priority Gold Products

The majority of Priority Gold’s products are IRA-approved gold and silver bullion designed to secure your retirement, but collectors can also purchase rare coins. Among their offerings are the following:

- 1 oz. Silver Rounds

- 10 oz. Silver Bar

- 1933 St. Gaudens Gold Double Eagle

- 1 oz. Austrian Gold Philharmonic

- Royal Canadian Mint Gold Arctic Fox

- Royal Canadian Mint Gold Maple Leaf

- Royal Canadian Mint Gold Polar Bear & Cub

- Royal Canadian Mint Silver Maple Leaf

- United States Mint Gold American Eagle

How It Works

To acquire precious metals from Priority Gold, you must choose coins or bars from their catalog and request a quotation. Priority Gold’s staff is committed to assisting you in selecting the most suitable precious metals for your investment requirements. In addition to ensuring that your IRA rollover is as simple and straightforward as possible, they are also committed to simplifying the process of liquidating your investments and have thus recently implemented a buy-back policy.

Precious Metals IRA

By seamlessly transferring your Individual Retirement Account (IRA), 401(k), 403(b), Thrift Savings Plan (TSP), or 457 Plan to Priority Gold’s specialized Precious Metal IRA Account, you can realize commensurate returns as if you were to directly invest in gold or silver. This strategic move enables you to capitalize on the inherent advantages offered by precious metals, all within the framework of your retirement account. The process of establishing your Precious Metals IRA with Priority Gold is streamlined through a straightforward four-step procedure as follows:

- First, furnish essential account holder information

- Second, designate beneficiaries for the account

- Third, specify the source of funds

- Fourth, provide clear transfer instructions.

This meticulous approach ensures a seamless and secure transition of your assets, aligning your financial goals with the enduring stability of precious metals within the confines of your retirement strategy.

Why Is a Gold IRA Important?

A Gold IRA holds significant importance for investors seeking a well-rounded and resilient retirement strategy. One key facet contributing to its significance lies in the array of tax advantages it offers. By investing in precious metals such as gold within an Individual Retirement Account (IRA), individuals can potentially enjoy tax benefits, including tax-deferred growth and the potential for tax-free withdrawals during retirement.

Additionally, a Gold IRA serves as a robust hedge against inflation, safeguarding the purchasing power of the investor’s portfolio over time. The inclusion of gold in an investment portfolio also contributes to effective diversification, mitigating risk and enhancing overall stability.

Moreover, a Gold IRA provides investors with unparalleled control over their self-directed investments, allowing for strategic decision-making in alignment with financial goals. The tangible nature of gold further ensures asset security, offering a physical and historically valued component that stands resilient in the face of economic uncertainties.

In summary, the multifaceted advantages of a Gold IRA make it a pivotal component in a well-structured retirement plan, providing investors with a powerful tool to navigate the complexities of the financial landscape while pursuing long-term wealth preservation and growth.

Custodian and Storage Facilities

Priority Gold takes immense pride in establishing a robust and mutually beneficial partnership with Preferred Trust Company, a distinguished and certified Retail Trust Company specializing in self-directed Individual Retirement Accounts (IRAs). Founded in 2007 and headquartered in the vibrant city of Las Vegas, Nevada, Preferred Trust Company has consistently demonstrated excellence in providing custodial and administrative services for IRA-owned gold and silver investments.

At the heart of Preferred Trust Company’s operations is a dedicated team committed to delivering personalized services to each IRA owner. Their personnel possess a wealth of expertise and collaborate seamlessly to ensure swift and efficient responses to any inquiries or issues related to precious metals investments. This commitment to exceptional service is underpinned by a thorough understanding of the intricacies of self-directed IRAs and a genuine dedication to meeting the unique needs of their clientele.

Being a reputable financial institution, Preferred Trust Company diligently adheres to all relevant Internal Revenue Service (IRS) rules and regulations governing self-directed IRAs. Additionally, the company maintains strict compliance with the guidelines set forth by the State of Nevada Financial Institutions Division, further reinforcing its commitment to regulatory integrity and client protection.

Clients engaging in gold or silver IRA investments with Priority Gold can take solace in the fact that their financial interests are safeguarded by the meticulous adherence to industry regulations by Preferred Trust Company. This not only underscores the professionalism of both entities but also provides clients with the confidence that their investments are being managed in strict accordance with legal and regulatory standards.

It is essential to note that while Priority Gold places great emphasis on the reliability of Preferred Trust Company as a custodian and administrator, it is imperative to clarify that Priority Gold has not disclosed any specific partnerships with storage or depository facilities. This transparency allows clients to make informed decisions about the custodial aspects of their precious metals investments, aligning with Priority Gold’s commitment to clarity and integrity in its business practices.

Benefits of Choosing a Reliable IRA Custodian and Storage Facility

Selecting a dependable IRA custodian and storage facility is paramount in safeguarding one’s investment, particularly in precious metals like gold. Opting for a reputable custodian ensures that your gold is stored in IRS-approved facilities, providing a crucial layer of protection against potential penalties. Compliance with IRS regulations is essential to maintaining the tax-advantaged status of your Individual Retirement Account, and a reliable custodian takes this responsibility seriously.

Furthermore, a secure storage facility not only mitigates the risk of damage to your precious metals but also safeguards against the potential threat of theft. By entrusting your gold to a trustworthy custodian and storage facility, investors can enjoy peace of mind, knowing that their valuable assets are well-protected and compliant with regulatory standards, thus maximizing the benefits of their IRA investments.

Pros and Cons of Priority Gold

In this section of our Priority Gold review, we discuss the pros and cons of the company in greater detail.

The Pros

-

Excellent Ratings and Reviews

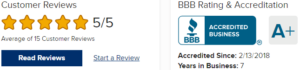

Priority Gold has received outstanding ratings on the majority of online review sites, such as the Better Business Bureau and the Business Consumer Alliance.

-

Lots of Free Information

Widespread free information about investing in precious metals is provided by the company. As an example, their website contains a resources section with a blog, precious metals price chart, free precious metals IRA Guide, and glossary of terms.

-

Quality Products

The majority of their products are IRS-approved for IRAs. Additionally, the company will help you choose the best products for your portfolio.

-

Buy Back Policy

Priority Gold formulated a buy-back policy after recognizing the need for clients to liquidate their investments. They guarantee competitive pricing if you purchased the product from them in the first place.

The Cons

-

Limited Product Selection

Priority Gold has a limited product selection because they only offer gold and silver, as opposed to other companies that also offer platinum and palladium.

-

Lack of Transparency

The company lacks fee transparency; you must contact them to obtain this information. In addition, Priority Gold provides no information about its management team or the precious metals storage depositories with which it collaborates.

Find Out Our Top-Rated Gold IRA Company Now>

Why Is Gold Considered a Safe Haven?

Gold is widely acknowledged as a safe haven asset, particularly during periods of economic or political instability. Its intrinsic value and historical significance contribute to its status as a reliable store of wealth. Unlike fiat currencies susceptible to inflation and credit-based assets carrying inherent risks, gold is not subject to the same vulnerabilities. The precious metal has maintained its allure throughout centuries due to its scarcity, durability, and universal acceptance.

Investors often turn to gold as a hedge against the erosion of purchasing power and financial market volatility. Its ability to preserve value and act as a timeless store of wealth positions gold as a resilient asset class, providing a sense of security in times of uncertainty. Central banks, institutional investors, and individuals alike consider gold an essential component of a diversified portfolio, recognizing its unique attributes that make it a steadfast refuge amid economic and geopolitical uncertainties.

How to Sell Your Precious Metals to Priority Gold

Priority Gold offers flexible options for selling any precious metal products purchased from them. You have three choices to sell your items:

-

Open Market Sale:

Opt for the highest Open Market Price by selling your portfolio independently. You have control over the selling price, allowing you to make decisions that align with your preferences. While this option has the potential to fetch the maximum selling price, it does require additional time and effort on your part.

-

Consignment Sale:

Let Priority Gold handle the sale for you. Your product(s) will be prioritized and sold through their active trading floor. The pricing is determined based on their current market ask price, with a 15% deduction covering marketing, transactional, shipping, and insurance costs associated with finding a new buyer.

-

Immediate Liquidation Sale:

Ideal for bullion metals, this option provides quick liquidity for investment-grade and numismatic coins. Priority Gold will Buy Back your metals at their current bid price. If you need immediate liquidity without incurring fees or charges from the firm, this option is available. However, you are responsible for the shipping and insurance fees required to deliver your metals to their facility.

Gold IRA Tax Rules

Navigating the realm of Individual Retirement Accounts (IRAs) requires a comprehensive understanding of the distinctive tax regulations associated with the two primary categories of precious metals IRA accounts. Traditional and Roth IRAs each encompass specific tax policies that significantly impact investment decisions.

Commencing with the traditional IRA, contributions to this account type typically qualify for tax deductions, thereby reducing taxable income in the year of contribution. However, upon reaching the stage of retirement distributions, these withdrawals are subject to taxation as ordinary income. Withdrawals made from a traditional IRA before reaching the age of 59 ½ may incur a 10% penalty, unless an exception applies. Moreover, mandatory minimum distributions are mandated once an individual attains a specific age, presently set at 73 in the year 2023.

Conversely, a Roth IRA operates under a distinct framework. Contributions to a Roth IRA are funded with after-tax dollars, foregoing immediate tax advantages. However, the benefit materializes during distributions, as these are generally exempt from taxation. Additionally, a Roth IRA permits penalty-free withdrawals of contributed funds at any time, though gains distributed prior to the age of 59 ½ may be subject to a 10% penalty and income taxes, unless specific exemptions are met. Unlike traditional IRAs, Roth IRA holders are not subject to mandatory minimum distribution requirements.

Reviews

Priority Gold reviews posted on the Better Business Bureau revealed that the company is not only accredited but holds a 5-star rating on the platform based on 10 user reviews and 1 complaint. In addition, based on 35 user reviews, they have a 5-star rating on the BCA. The company lacks reviews and ratings on Trustpilot, Trustlink, and Yelp, among other significant review websites.

- BBB: A+ Rating, 10 reviews

- BCA: AAA rating, 35 reviews

- Trustlink: No reviews

- Yelp: No reviews

- Trustpilot: Not Listed

Is Priority Gold a Scam?

Do you have faith in Priority Gold? Is the company a scam or legitimate? As they are accredited by the BBB, Priority Gold is undoubtedly a legitimate business. In addition, the majority of their online reviews are positive, which would not be the case if the company was a scam.

Alternatives to Priority Gold

Conclusion

Priority Gold is a gold and silver dealer based in Sherman Oaks, California. The company has been selling rare coins and high-quality bullion for over six years. They have a buy-back policy in effect to facilitate the liquidation of your assets.

Unfortunately, Priority Gold does not offer platinum or palladium products. In addition, there is no information about their administrators, fees, or storage depositories on their website.