Can’t decide whether to use the custodial services provided by Preferred Trust Company? To find out the answers to all of your questions, read our Preferred Trust Company reviews.

What Is Preferred Trust Company?

Based in Paradise, Nevada, Preferred Trust Company is a licensed trust company. The company, which was founded in 2007, serves as the custodian and administrator of self-directed IRAs. Their goal is to offer their clients around the nation unmatched customer service as well as customer education.

Does Preferred Trust Company Offer Precious Metals IRAs?

Preferred Trust Company does not sell precious metals or other investments. If you are interested in opening a Precious Metals IRA, we recommend Goldco because it offers both self-directed IRAs and IRA-approved precious metals.

Preferred Trust Company Review Summary

Location:

Paradise, Nevada

Address:

2140 E Pebble Rd #140, Las Vegas, NV 89123, United States

Year Founded:

2007

Management:

Christina Trembly (Director of Operations)

Website:

www.preferredtrustcompany.com

Rating:

[usr 4.3]

Find Out Our Top-rated Gold IRA Provider Here>

Preferred Trust Company Products & Services

Preferred Trust Company assists with the opening of self-directed IRAs, including Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and Trust Accounts. The majority of their clients invest in alternative assets, such as digital currencies, IRA LLCs with Checkbook Control, Limited Partnerships, Deeds of Trust, Private Placements, Private Lending, Precious Metals, Real Estate, Tax Liens, Trust Deeds, and many others.

How It Works

Visit Preferred Trust Company’s website and select the ‘open account’ link to gain access to account application forms. Choose the type of self-directed IRA you wish to establish, then submit the application form online via Adobe E-Sign or by downloading it in PDF format. The following details are necessary to conclude the application process:

- Valid photo ID

- Your beneficiaries name, SSN, relationship, and percentage designation.

If you need assistance during the application process, you can call or email Preferred Trust Company’s customer service representatives.

Preferred Trust Company Fee Schedule

The following is the standard fee schedule for Preferred Trust Company:

Account Setup & Account Termination Fees

- Account setup Fee: $50

- Account Termination Fee: $300

Annual Account Administration Fees

- $0-$50,000: $300

- $50,001-$100,000: $400

- $100,001-$200,000: $500

- $200,001-$300,000: $600

- $300,001-$400,000:$700

- $400,001-$500,000:$800

- $500,001-$600,000: $900

- >$600,000: $1000

Pros of Preferred Trust Company

-

Client Education Is Offered

The mission of Preferred Trust Company is to provide customer education; consequently, they offer free resources to help you comprehend the alternative assets that can be held in a self-directed IRA. In addition, they have a comprehensive ‘Frequently Asked Questions’ section.

-

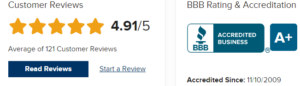

Excellent Reviews and Ratings

They have a 4.82-star rating with the Better Business Bureau and a 5-star rating on many other review websites. In addition, they have few negative comments and complaints.

-

Great Customer Support

Preferred Trust Company is able to assist you whenever you require assistance due to its knowledgeable customer service staff. Support is available via phone, email, and live chat.

Cons of Preferred Trust Company

-

High Costs

Despite their candor and transparency, their fees appear to be higher than those of most IRA custodians.

Customer Reviews & Ratings

Preferred Trust Company reviews on the BBB award the company a 4.83/5-star rating based on 232 client reviews and one complaint. On Trustpilot, they have a rating of 2.4/5 based on 10 customer reviews, whereas, on Yelp, they have a rating of 5/5 based on 3 customer reviews. There are no reviews or ratings for Preferred Trust Company on the Business Consumer Alliance and Trustlink.

Is there a Better Alternative to Preferred Trust Company?

Preferred Trust Company is a reputable custodian for self-directed IRAs. The company does not sell investments nor provide investment advice. For this reason, we recommend a firm that provides both self-directed IRA accounts and investment assets. You can learn more about our top-recommended alternative by following the link provided below.

Click here to learn about our #1 recommended alternative

Is Preferred Trust Company Legit or Scam?

Preferred Trust Company is a state-regulated organization with over 14 years of experience specializing in self-directed accounts, so it is a legitimate business.

More Alternatives to Preferred Trust Company

Preferred Trust Company Reviews Conclusion

Preferred Trust Company is a custodian for self-directed IRAs whose mission is to provide customers with unmatched IRA services and education. The company takes pride in providing exceptional customer service, which is supported by the positive ratings and reviews posted online. However, Preferred Trust Company’s fees are higher than those of the majority of its competitors.