Should your retirement funds be invested in New Direction IRA? Perhaps you have encountered conflicting reviews and ratings and are unable to decide. Then, consider this comprehensive New Direction IRA review in order to make an informed investment decision.

Table of Contents

- 1 What Is New Direction IRA?

- 2 New Direction IRA Review Summary

- 3 Location:

- 4 Address:

- 5 Year Founded:

- 6 Management:

- 7 Website:

- 8 Rating:

- 9 New Direction IRA Products & Services

- 10 How Does It Work?

- 11 Open Your Account

- 12 Fund Your Account

- 13 Choose Your Investments

- 14 Manage Your Account

- 15 New Direction IRA Fee Schedule

- 16 Pros of New Direction IRA

- 17 Experienced Executive Team

- 18 Many Account Options

- 19 Provides Free Client Education

- 20 Great Website

- 21 Cons of New Direction IRA

- 22 Shipping Delays

- 23 Sliding Scale Fees

- 24 New Direction IRA Reviews, Accreditation & Ratings

- 25 Is New Direction IRA Legit or a Scam?

- 26 New Direction IRA Alternatives

- 27 Conclusion

What Is New Direction IRA?

New Direction IRA is a self-directed IRA provider and administrator based in Louisville, Colorado. The company has acquired immense popularity among investors and asset providers as a result of its more than two decades in business and highly experienced executive team. The company has heavily invested in cutting-edge technology and customer education to assist investors and facilitate self-direction.

New Direction IRA Review Summary

Location:

Louisville, Colorado

Address:

1070 W Century Dr Ste 101

Louisville, CO 80027-1657

Year Founded:

2003

Management:

William Humphrey (CEO)

Website:

www.ndtco.com

Rating:

[usr 3]

Find Out Our Top-rated Gold IRA Company On This Page

New Direction IRA Products & Services

New Direction IRA affords you numerous opportunities to invest and take charge of your future finances. Eight account categories are available, including Roth IRA, Traditional IRA, SIMPLE IRA, SEP IRA, Inheritance IRAs, 401(k), Education Savings Account, and Health Savings Account. With these accounts, you can invest in alternative assets including real estate, precious metals, private lending, checkbook IRAs, and private equity. In addition, they engage in customer education by continuously hosting webinars and developing educational tools to empower and direct investors.

How Does It Work?

Similar to other self-directed IRA providers, the company predominantly offers online services. Before you begin investing, you can obtain their free investing guides for crucial information and insight. Once you’ve chosen your optimal investment options, you can proceed with the following steps:

-

Open Your Account

After selecting an account that aligns with your investment objectives, proceed to complete the online application form on the New Direction IRA website. This procedure will take no longer than 15 minutes.

-

Fund Your Account

Finance your self-directed account with a transfer, rollover, or contribution.

-

Choose Your Investments

Choose the alternative asset classes in which you will invest. If you encounter any difficulties selecting your assets, the knowledgeable personnel at New Direction IRA will be available to assist you.

-

Manage Your Account

After account setup, you may use their online platform to administer your account.

New Direction IRA Fee Schedule

New Direction IRA charges sliding scale fees which is a disadvantage in our view as it imposes higher fees on investors with larger accounts. For instance, the account setup fee is $50, while the annual fee is $75 for accounts under $100, 000 and $125 for accounts over $100, 000. Not to mention yearly storage fees which vary depending on the storage provider you choose.

Pros of New Direction IRA

-

Experienced Executive Team

The company is managed by a team of highly accomplished financial advisers, accountants, economists, and lawyers. It boasts one of the most experienced executive teams in the industry.

-

Many Account Options

New Direction IRA offers many account options and unlimited investment opportunities to its clients.

-

Provides Free Client Education

Free client education is continually provided through webinars, investment guides, and other educational tools. Their education not only empowers but also equips investors with crucial knowledge to make their retirement investments a reality.

-

Great Website

They’ve embraced digital innovation and this is demonstrated by their modern website which has streamlined self-direction and made it even more intuitive.

Cons of New Direction IRA

-

Shipping Delays

We’ve found a considerable number of negative customer reviews and complaints condemning shipping delays by the company.

-

Sliding Scale Fees

As we’ve noted, New Direction IRA charges sliding scale fees known to be quite expensive, particularly for investors with larger accounts.

Here Is Our #1 Recommended Gold IRA Provider

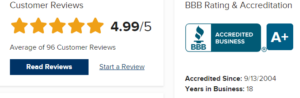

New Direction IRA Reviews, Accreditation & Ratings

Based on 162 customer evaluations, the Better Business Bureau has awarded New Direction IRA a rating of 4.97 out of 5 stars. Nonetheless, the BBB has resolved 19 consumer complaints regarding the company in the past three years.

According to 42 customer evaluations on Yelp, New Direction IRA has earned a rating of 2 out of 5 stars. And surprisingly, the company lacks customer reviews, ratings, and complaints on other key review platforms, including Trustpilot, Trustlink, and the Business Consumer Alliance.

Is New Direction IRA Legit or a Scam?

Based on the positive reviews and high ratings posted on the BBB and other online resources, it is evident that New Direction IRA is not a scam.

New Direction IRA Alternatives

Conclusion

New Direction IRA is a self-directed IRA custodian based in Louisville, Colorado. They are one of the nation’s leading IRA providers, administered by a team of seasoned executives. New Direction IRA is renowned for utilizing modern technology to provide investors with cutting-edge education and limitless investment opportunities.

On the other hand, New Direction IRA has been accused of shipping delays as well as excessive sliding scale fees.