Review of Summit Trust Company: One of the most prominent self-directed IRA custodians in the United States, but is it the best choice for you? What do clients have to say about them? This article will provide comprehensive information about Summit Trust Company.

Attention: Summit Trust Company has ceased operations. Check out our alternative self-directed IRA custodian by clicking the link below.

Click here to check out our alternative self-directed IRA provider

What Is Summit Trust Company?

Summit Trust Company is one of Nevada’s largest self-directed IRA custodians, and it was founded to provide customers with the opportunity to invest in alternative assets. The company was established in 2003 and is known for providing up to six account categories and a large number of alternative assets.

Summit Trust Company Review Summary

Location:

Las Vegas, Nevada

Address:

8861 W Sahara Ave STE 215

Las Vegas, NV 89117-4807

Year Founded:

2003

Management:

Kevin Brown (President)

Website:

www.summittrust.com

Rating:

[1/5]

Learn about our #1 recommended gold & silver IRA provider here>

Summit Trust Company Products & Services

Summit Trust Company offers SEP IRA, Roth IRA, Traditional IRA, Defined Contribution Plan, Individual 401 (k), and Trust Account self-directed IRA accounts. These accounts permit you to invest your retirement funds in alternative assets such as real estate, precious metals, and private lending, among others.

How It Works

You can access the services of Summit Trust Company via their website or by visiting their Las Vegas office. The company provides a phone number for contacting customer service with questions or to create an account.

Summit Trust Company Fees

Summit Trust Company offers limited fee information. On their website, we were unable to locate information regarding annual fees. However, our exhaustive investigation revealed that they charge $100 for account establishment and up to $175 for account cancellation.

Pros of Summit Trust Company

-

Multiple Account Types

They offer up to six account categories and the opportunity to invest in a variety of alternative assets.

-

Many Years In Business

Since they have been in business for nearly two decades, they have earned a great deal of credibility.

Cons of Summit Trust Company

-

Limited Information On Fees

They provide scanty information in regard to their fee schedule. We always advise our followers to choose custodians with completely transparent fee structures.

-

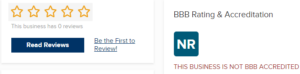

No Reviews Online

Summit Trust Company does not have any customer reviews on the majority of online platforms. They even lack Better Business Bureau accreditation.

-

Outdated Website

Summit Trust Company’s website is outdated and lacks navigation and specific product and service information. In addition, they only provide a phone number for client communication, which is inconvenient and time-consuming compared to the live chat support offered by modern businesses.

-

Out of Business

According to our knowledge, Summit Trust Company is currently in receivership and is no longer accepting new clients. This is a devastating setback to the firm’s potential investor clientele.

Summit Trust Company Reviews & Ratings

On nearly all review websites, there are no testimonials for Summit Trust Company. To begin with, they lack a BBB accreditation which is crucial for assessing a company’s credibility. Most investors turn to BBB accreditation and rating to find out whether a company is worth investing in.

In addition to the absence of BBB accreditation and reviews, Summit Trust Company also lacks reviews on other major third-party review websites including Trustlink, BCA, Trustpilot, and Yelp.

Is there a Better Alternative?

First, you must be aware that Summit Trust Company lacks both transparency and high ratings. Secondly, and perhaps most importantly, you must be aware that they are presently out of business. Goldco is our top-recommended alternative to Summit Trust Company. Goldco is one of the few businesses that offer a flat-rate, one-time fee and boasts outstanding customer ratings. Follow the link provided to find out more about them.

Click Here To Learn About Goldco, Our #1 Recommended Precious Metals IRA Provider

Is Summit Trust Company Legit or Scam?

Summit Trust Company is a legitimate Las Vegas-based organization. Since it has been in operation since 2003, it is certainly not a hoax.

Summit Trust Company Alternatives

- Horizon Trust Company Reviews

- American IRA

- Austin Capital Trust Company

- DirectedIRA.com

- Real Trust IRA

Summit Trust Company Reviews Conclusion

Summit Trust Company is a Las Vegas-based self-directed IRA custodian. The company has been in business for nearly two decades and is proud to offer numerous account categories.

Summit Trust Company lacks BBB accreditation and reviews on the majority of third-party review websites. Additionally, they provide limited fee information and are currently in receivership.