Unlocking the full story of this top-rated gold IRA provider — what it offers, how it works, who it’s right for, and where it falls short.

Are you looking to safeguard your retirement savings from inflation, stock-market gyrations, and economic uncertainty? If so, chances are you’ve searched for Augusta Precious Metals reviews — and you’ve likely found plenty of praise. But before you commit your hard-earned dollars (or roll over a 401(k)), it’s critical to dig beneath the headlines.

In this detailed review, we’ll look at exactly how Augusta Precious Metals (APM) operates, what makes it stand out, and whether it might be the right choice for you. We’ll walk through their ownership, product lineup, process, fee structure, customer feedback, and more — giving you a full picture so you can decide with confidence.

Table of Contents

- 1 What Is Augusta Precious Metals?

- 2 Who Owns Augusta Precious Metals?

- 3 Augusta Precious Metals Products & Services

- 4 Products

- 5 Services

- 6 IRA Custodians

- 7 How Does It Work?

- 8 Important considerations

- 9 Pros of Augusta Precious Metals

- 10 Augusta Precious Metals Website

- 11 Cons of Augusta Precious Metals

- 12 Augusta Precious Metals Fee Structure

- 13 Customer Reviews & Complaints

- 14 Is Augusta Precious Metals Legit?

- 15 Comparison Table – Augusta vs Other Leading Providers

- 16 Augusta Precious Metals Reviews- Conclusion

- 17 Frequently Asked Questions (FAQ)

- 18 Alternative Gold IRA Companies

What Is Augusta Precious Metals?

Headquartered in Casper, Wyoming, Augusta Precious Metals is a firm that helps individuals diversify retirement savings by investing in physical gold and silver, primarily via gold IRAs. The company also supports direct (non-IRA) bullion and coin purchases for home delivery.

Key aspects of their offering:

- Investment products: APM specializes in gold and silver, offering physical bullion and premium coins for either IRA inclusion or cash purchase.

- Gold IRAs: They facilitate self-directed IRAs that hold physical gold or silver — requiring IRS-approved depository storage.

- Customer support: Lifetime customer support is a key promise — each client receives a dedicated contact and ongoing education.

- Education focus: A major differentiator is APM’s heavy emphasis on investor education (webinars, guides, reviews of scams) rather than high-pressure sales.

- Recognition: The company holds an A+ rating from the Better Business Bureau (BBB) and is accredited.

Secure your financial future today! Request your Free Gold IRA Guide from Augusta Precious Metals and gain exclusive insights into their products, fees, and the steps to protect your retirement with precious metals.

REQUEST YOUR FREE GOLD IRA GUIDE NOW>

Who Owns Augusta Precious Metals?

The founder and CEO of the company is Isaac Nuriani. He started Augusta in 2012 with a mission to educate Americans about the benefits (and risks) of precious-metals diversification.

Under his leadership, the company has remained focused on gold and silver (rather than branching into crypto or other alternative assets). According to industry reviews, this narrow focus gives APM deeper expertise in its niche.

Augusta Precious Metals Products & Services

APM’s offering can be divided into two major categories: products (what you buy) and services (how it works).

Products

Gold products

- U.S. Gold Eagles in 1 oz, ½ oz, ¼ oz, 1/10 oz — both bullion and proof versions.

- Gold American Buffaloes (1 oz, .9999 fine).

- Canadian Gold Maple Leafs (.9999 fine).

- Austrian Gold Philharmonics (1 oz).

- South African Gold Krugerrands.

- Gold bars in various weights (1 oz, 10 oz).

- Premium/historic gold coins and collectibles (e.g., St Helena Gold Sovereign, historic U.S. gold coin sets).

Silver products

- American Silver Eagles (.999 fine).

- Canadian Silver Maple Leafs (.9999 fine).

- Austrian Silver Philharmonics (1 oz).

- Silver bars (10 oz, 100 oz).

- America the Beautiful 5-oz silver coins.

- Historic U.S. silver coins (90% pre-1965 coins, Franklin half-dollars, Mercury dimes).

Note: Unlike some rivals, APM does not currently offer platinum or palladium as part of its IRA program.

Services

- Precious-Metals IRAs: Full assistance with setting up a self-directed IRA, rolling over an existing 401(k) or IRA, selecting IRS-approved coins/bars, and arranging storage.

- Cash purchases: If you prefer to buy outright (outside an IRA), APM allows direct bullion/coin purchases with home delivery.

- Educational resources: Free guides, webinars led by industry analysts, a video library, and one-on-one consultations.

- Lifetime customer support: Each client gets a dedicated “customer success agent” and ongoing access for questions.

- Secure storage options: Metals can be stored in IRS-approved depositories (e.g., Delaware Depository) with segregated or pooled storage choices.

IRA Custodians

Augusta Precious Metals partners with a handful of thoroughly vetted IRA custodians, with Equity Trust serving as their preferred and top-recommended option for gold and silver IRAs. These custodians—such as Equity Trust—manage all IRS compliance, record-keeping, and administrative responsibilities for your self-directed IRA, ensuring your physical precious metals are stored securely and in full accordance with federal regulations. Augusta acts as your liaison throughout the process, coordinating seamlessly between you and the custodian.

Equity Trust – Augusta’s #1 recommended custodian, known for its strong track record in handling precious metals IRAs.

Other available custodians include:

• GoldStar Trust

• Kingdom Trust

Your role: You work directly with the custodian for administrative and compliance matters, while Augusta handles the metal purchases and guides you through each step as an intermediary.

REQUEST YOUR FREE GOLD IRA GUIDE NOW>

How Does It Work?

Here’s a step-by-step breakdown of how the process typically works with APM:

Step 1: Speak with an agent and attend a webinar

- You request a free info guide from Augusta Precious Metals. A call is scheduled with a customer success agent.

- You’re invited to join an educational web conference (often led by a senior economist) covering precious-metals investing, IRA rules, and portfolio strategy. APM is noted for a no-pressure sales approach.

Step 2: Set up and fund your account

- Choose between a Gold/Silver IRA or a cash account for direct purchase.

- For the IRA route: APM works with you to establish a self-directed IRA via a partner custodian (such as Equity Trust), handles paperwork for a rollover/transfer, and ensures IRS compliance.

- For cash purchases: You arrange the funds and prepare for a direct transaction.

Step 3: Purchase your precious metals

- APM connects you to their order desk. You select the approved products (coins/bars) that align with your goals.

- Since prices change with the market, you confirm your order over the phone and lock in the price. Some clients note that product prices are not posted on the website, so transparency on real-time pricing is via agent phone call.

- Important stipulation: APM requires a minimum investment of $50,000 for new IRA clients.

Step 4: Arrange storage or delivery

- For IRAs: APM sends the metals (fully insured and tracked) to an IRS-approved depository, either pooled or segregated storage.

- For cash purchases: Delivery is made to your home (or preferred secure location) via insured shipping.

Important considerations

- Minimum Investment: A minimum investment of $50,000 is required.

- No direct online checkout: Augusta Precious Metals requires phone confirmation of orders — you cannot simply click “buy” on the website.

Request Your FREE Info Guide from Augusta Now!

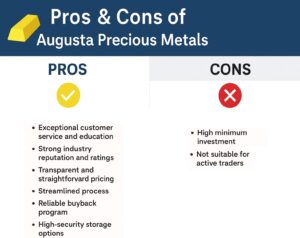

Pros of Augusta Precious Metals

Here are some of the strongest points raised consistently in reviews:

- Exceptional customer service & education: Numerous reviewers praise the “no-pressure”, educational approach.

- Strong industry reputation & ratings: APM holds an A+ rating with the BBB and a AAA rating with the Business Consumer Alliance.

- Transparent, straightforward pricing: Reviewers note fewer hidden fees compared to industry peers.

- Streamlined process: The setup, rollover, and purchase processes are handled end-to-end, relieving much of the admin burden from the customer.

- Reliable buyback program: While results can vary, APM has a track record of facilitating buy-backs (liquidation) without punitive liquidation fees.

- Secure storage options: Using top-tier IRS-approved depositories gives peace of mind to retirement-savvy investors.

Augusta Precious Metals Website

Augusta Precious Metals provides a wide range of educational resources to help investors understand the ins and outs of precious metals and how they fit into a retirement strategy. Their key educational tools include:

Knowledge Hub: A comprehensive library of articles, expert insights, and market commentary designed to deepen your understanding of precious metals investing and broader economic trends.

Video Library: A collection of high-quality, professionally produced videos covering everything from precious metals fundamentals to advanced market analysis and scam prevention.

Free Guides: Augusta offers downloadable guides—such as their Gold IRA Guide—that walk investors through the basics of precious metals IRAs, IRS requirements, tax considerations, and retirement diversification strategies.

Market News & Trends: Weekly market updates and analysis from financial professionals, including insights from a Harvard-trained economist, help investors stay informed about economic forces influencing gold and silver.

One-on-One Web Conferences: Prospective clients can attend personalized, no-pressure web sessions with Augusta’s education team to learn about the economy, diversification, and how the gold IRA process works from start to finish.

FAQs and Risk Disclosures: Detailed FAQs and transparent risk disclosures ensure investors clearly understand both the benefits and potential risks of investing in physical precious metals.

Product Information: The site provides thorough descriptions of Augusta’s gold and silver offerings, including coins and bars, whether purchased directly or through an IRA.

Together, these resources demonstrate Augusta’s education-first philosophy—helping investors make confident, well-informed decisions about protecting and diversifying their retirement savings with physical gold and silver.

Cons of Augusta Precious Metals

No company is perfect. Here are the most commonly cited drawbacks:

- High minimum investment: The ~$50,000 minimum is burdensome for many smaller investors.

- Limited product selection (no platinum/palladium): If you want exposure to platinum or palladium, APM isn’t the right fit.

- No fully online purchase option: Requiring phone confirmation might feel outdated or inconvenient for digital-first investors.

- Focus on long-term, not for active traders: The model assumes you’re investing for retirement diversification rather than frequent trades; if you want active trading, another platform may serve you better.

Augusta Precious Metals Fee Structure

Below is a simplified fee breakdown based on publicly available sources:

| Fee Type | Approximate Amount |

|---|---|

| Account Setup Fee | ~$50 (one-time) |

| Annual Administration Fee | ~$80-$125 (depending on account size) |

| Annual Storage Fee | ~$100 (non-segregated; varies) |

| Minimum Investment | ~$50,000 |

Note: Augusta Precious Metals may waive setup/fees for [up to 10 years] depending on investment size.

When comparing to industry peers, the fees are competitive for an upper-end service, though the high entry bar means the perks carry a price.

Customer Reviews & Complaints

The feedback from actual clients is overwhelmingly positive, though with a few caveats:

- On Trustpilot, APM holds a near-5.0-star average across over 200 reviews.

- On the BBB profile, the company is praised for smooth processes and professionalism.

- Many reviewers highlight the educational webinar, the patience of agents, and the transparent process:

“Very Professional… answered all our questions” (Better Business Bureau)

“Premiums a little on the high side but Company seems quite trustworthy so it’s worth it to me.” (Trustpilot) - On the downside, some mention that the minimum investment is steep.

In terms of complaints, third-party analysis notes that Augusta Precious Metals has had no significant lawsuits or unresolved regulatory actions as of January 2026.

Is Augusta Precious Metals Legit?

Yes, based on available evidence, Augusta Precious Metals is a legitimate, well-established company operating in compliance with IRS rules for self-directed precious-metals IRAs. Key legitimacy signals include:

- Strong third-party ratings (BBB A+, BCA AAA)

- Transparent fee disclosures

- Real reviews from real customers

- Publicly documented ownership and business operations

Get Your FREE Info Kit from Augusta

Comparison Table – Augusta vs Other Leading Providers

Here’s a high-level comparison of Augusta Precious Metals against typical competitors (for illustration only):

| Feature | Augusta Precious Metals | Typical Competitor |

|---|---|---|

| Minimum Investment | ~$50,000 | Often $10,000-$25,000 or lower |

| Product Focus | Gold & Silver only | Gold, Silver, + Platinum/Palladium |

| Online Self-Service | No orders via phone | Some allow online ordering |

| Educational Support | Dedicated webinars + one-on-one agents | Varies; many offer basic resources |

| Storage Options | IRS-approved depositories (seg/pool) | Similar |

| Fee Transparency | High transparency | Some firms have hidden or complex fees |

| Buy-back Program | Good track record | Varies |

Augusta Precious Metals Reviews- Conclusion

If you are serious about diversifying a sizeable portion of retirement savings into physical gold or silver and you value education, personalized service, transparency, and top-tier client support, then Augusta Precious Metals presents a compelling choice.

However, if you’re a smaller investor, want to include platinum/palladium, prefer online-only transactions, or seek a low minimum investment, then you might want to explore other firms. Always remember: no investment is risk-free, and precious metals should form a portion of a broader, balanced retirement strategy — not your entire portfolio.

Frequently Asked Questions (FAQ)

Q1: What is the minimum investment required with Augusta Precious Metals?

A: A minimum of $50,000 is required for a gold/silver IRA with Augusta.

Q2: Does Augusta offer platinum or palladium IRAs?

A: No, Augusta currently focuses exclusively on gold and silver products.

Q3: Can I purchase online directly with Augusta?

A: No, orders are placed via phone after speaking with an agent and attending a webinar.

Q4: Where are the metals stored?

A: For IRA accounts, metals are shipped to IRS-approved depositories (such as Delaware Depository) and stored in segregated or pooled storage.

Q5: Are there any lawsuits or major complaints against Augusta?

A: As of January 2026, there are no major lawsuits publicly documented against Augusta in the review sources we checked.

Q6: Is Augusta suitable for small investors?

A: Not particularly, due to the high minimum investment of $50k, it’s better suited for investors with substantial capital to deploy.

Request Your FREE Info Guide from Augusta Now