If you’re worried about inflation, stock market volatility, or the weakening dollar, you’re not alone. Many Americans nearing retirement are asking the same question:

“Can I move my 401(k) into gold and protect my savings?”

The answer is yes, with a 401k to Gold IRA rollover. This IRS-approved move lets you diversify your retirement funds into physical gold and other precious metals while keeping all the tax benefits of a retirement account. In this guide, you’ll discover how a Gold IRA works, why it’s become a popular hedge against risk, and the exact steps to roll over your 401k without penalties or headaches.

Table of Contents

- 1 Why Consider Moving Your 401(k) Into Gold?

- 2 1. Hedge Against Inflation

- 3 2. Portfolio Diversification

- 4 3. Safe-Haven Asset

- 5 4. Tax Advantages

- 6 What Is a Gold IRA?

- 7 Direct vs. Indirect Rollovers — Why It Matters

- 8 How to Do a 401k to Gold IRA Rollover (Step-by-Step)

- 9 1. Choose a Reputable Gold IRA Company

- 10 2. Open a Self-Directed IRA Account

- 11 3. Contact Your Current 401(k) Administrator

- 12 4. Select Your Precious Metals

- 13 5. Secure IRS-Approved Storage

- 14 6. Track and Manage Your Investment

- 15 Common Mistakes to Avoid

- 16 Tax & Penalty Considerations

- 17 How Much Should You Roll Over?

- 18 Ready to Roll Over Your 401 (k) into Gold?

- 19 Final Thoughts — Is a 401k to Gold IRA Rollover Right for You?

- 20 Quick Checklist

Why Consider Moving Your 401(k) Into Gold?

Before diving into the process, it’s important to understand why thousands of retirees and pre-retirees are exploring precious metals:

1. Hedge Against Inflation

Unlike paper assets that can lose purchasing power when inflation rises, gold historically maintains value. Over the past decade, gold has often moved opposite to stocks and the dollar.

2. Portfolio Diversification

Most 401(k) plans are heavily invested in equities and bonds. A Gold IRA lets you spread risk by adding tangible assets that often behave differently during market downturns.

3. Safe-Haven Asset

When geopolitical tensions or banking issues surface, gold demand typically spikes. Having a portion of your retirement in physical gold can act as a safety net during uncertainty.

4. Tax Advantages

A rollover keeps your retirement account’s tax-deferred status — meaning no immediate taxes or penalties if you follow IRS rules.

What Is a Gold IRA?

A Gold IRA (Individual Retirement Account) is a self-directed IRA that allows you to hold physical gold, silver, platinum, and palladium instead of only stocks and mutual funds.

Unlike a standard IRA that’s custodian-controlled, a self-directed IRA gives you more flexibility and choice in what you invest in — including IRS-approved bullion and coins.

Direct vs. Indirect Rollovers — Why It Matters

When moving your 401(k) to gold, there are two methods:

- Direct Rollover (Recommended): Your 401k provider sends the funds straight to your new Gold IRA custodian. You never touch the money, so there’s no tax withholding or penalty risk.

- Indirect Rollover (Risky): The funds come to you first, and you have 60 days to deposit them into the new account. Miss the deadline and the IRS could treat it as a taxable withdrawal plus penalties.

For simplicity and compliance, most experts recommend a direct rollover.

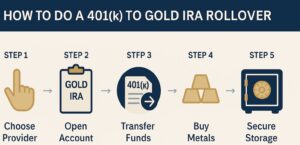

How to Do a 401k to Gold IRA Rollover (Step-by-Step)

Follow these steps to move your retirement savings into gold safely and efficiently:

1. Choose a Reputable Gold IRA Company

Not all custodians handle physical gold. Look for companies with strong ratings (A+ BBB, Trustpilot reviews), transparent fees, and excellent customer service. They’ll help set up your self-directed IRA and guide you through IRS compliance.

Tip: Compare storage fees, buyback programs, and educational resources before choosing.

2. Open a Self-Directed IRA Account

Once you’ve chosen your Gold IRA provider, you’ll fill out paperwork to create a new self-directed IRA. This step is quick and usually completed online.

3. Contact Your Current 401(k) Administrator

Tell your plan administrator that you want to roll over funds to your new IRA. Request a direct rollover — meaning the check or transfer goes directly to your new custodian, not you personally.

Important: Provide your new account details (supplied by your Gold IRA company) to avoid delays.

4. Select Your Precious Metals

After the funds arrive in your new IRA, you can choose the type of gold or other metals to hold. The IRS only allows certain coins and bars, such as:

- American Gold Eagle coins

- Canadian Gold Maple Leafs

- 0.995+ fine gold bars from approved refiners

Your account rep can help ensure your choices are IRS-compliant.

5. Secure IRS-Approved Storage

You can’t store IRA gold at home. It must be kept in an IRS-approved depository for safety and tax compliance. Your custodian will arrange secure vault storage and insurance.

6. Track and Manage Your Investment

Your custodian will provide account statements and value updates. You can rebalance, add funds, or liquidate when needed — just as with other IRAs.

✅ Tip: Before you begin your rollover, it’s smart to know the fees, approved metals, and storage options.

Common Mistakes to Avoid

- Missing the 60-Day Deadline (Indirect Rollover): Avoid indirect rollovers unless you’re certain you can redeposit funds on time.

- Choosing Non-Approved Metals: Stick to IRS-eligible coins and bars to keep your tax-advantaged status.

- Working With Unverified Dealers: Always research a company’s track record and reviews before trusting them with retirement funds.

Tax & Penalty Considerations

When done correctly (via direct rollover), you won’t owe taxes or early withdrawal penalties.

However, if you accidentally take possession of the funds and don’t deposit them into your new IRA within 60 days, the IRS may treat it as a taxable distribution — and if you’re under 59½, a 10% penalty could apply.

Your Gold IRA provider and custodian can help you avoid these pitfalls.

How Much Should You Roll Over?

There’s no single answer — it depends on your risk tolerance and financial goals. Many experts suggest allocating 5–20% of retirement savings to precious metals for diversification, but some conservative investors go higher.

It’s wise to speak with a financial advisor to match your allocation to your retirement timeline and overall strategy.

Ready to Roll Over Your 401 (k) into Gold?

Click the button below to request your FREE Info Guide and get expert tips and IRS rules in plain English.

Request Your FREE Info Guide Now!

Final Thoughts — Is a 401k to Gold IRA Rollover Right for You?

If you’re concerned about market volatility, inflation, or preserving purchasing power in retirement, moving a portion of your 401(k) into gold can provide peace of mind.

A 401k to Gold IRA rollover:

- Keeps your tax benefits

- Lets you own tangible assets

- Adds a hedge against market and currency risks

The key is working with a trusted, IRS-compliant Gold IRA company and choosing a direct rollover to avoid mistakes. Once complete, you’ll have a more resilient retirement portfolio and greater control over your financial future.

Quick Checklist

- ✅ Pick a reputable Gold IRA provider

- ✅ Set up a self-directed IRA

- ✅ Request a direct rollover from your 401(k)

- ✅ Choose IRS-approved gold and metals

- ✅ Use an IRS-approved depository for storage

By following this guide, you’ll be positioned to protect your hard-earned savings with a time-tested asset — gold — while staying fully compliant and tax-advantaged.